Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

Assets under management (AUM), also called funds under management, is the total market value of the securities a financial institution (such as a bank, mutual fund, or hedge fund) owns or manages on behalf of its clients.

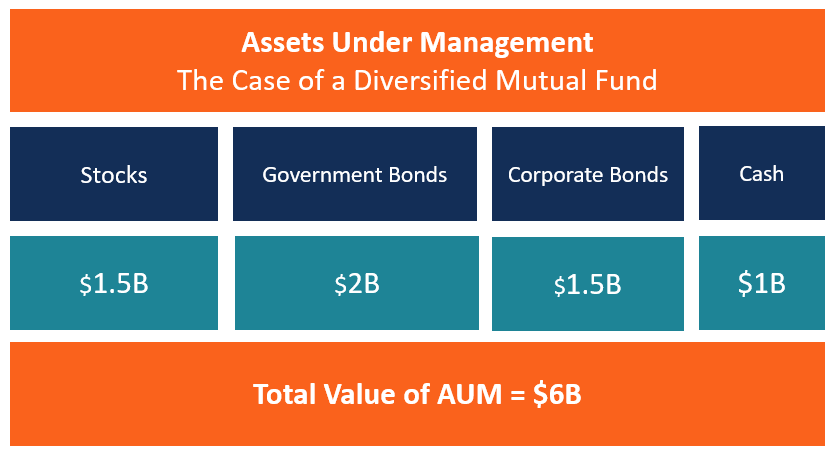

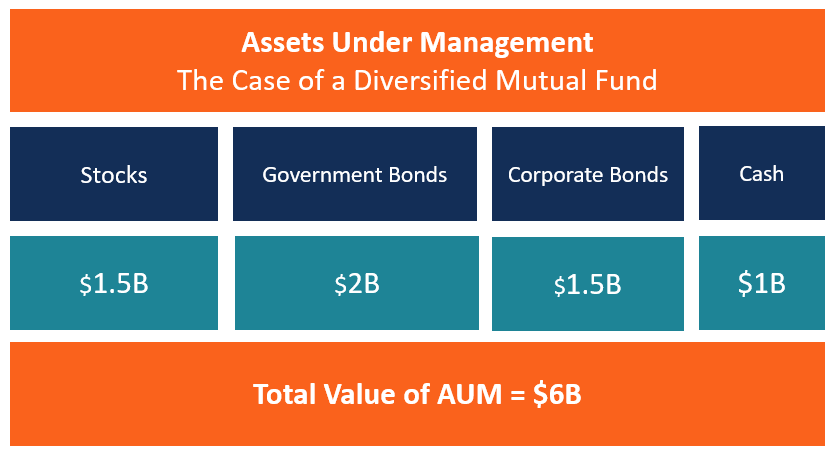

Let’s take the example of a mutual fund with a diversified portfolio of stocks and bonds and a significant cash position. Let’s suppose that the mutual fund’s portfolio consists of $1.5B in stocks, $2B in government bonds, $1.5B in corporate bonds, and $1B in cash.

The total value of the fund’s assets under management will be $6B.

The total value of AUM is a measure of the size of a financial institution and a key performance indicator of success, as a larger AUM generally translates into larger revenue in the form of management fees. That’s why financial institutions look at the value of AUM and compare it to competitors and to their own history to assess business trends.

Moreover, in some jurisdictions, the value of assets under management may determine whether an institution must comply with specific regulations.

The way institutions or investors calculate assets under management can differ slightly. Some banks may include deposits and cash, mutual funds, and their calculations. Other institutions consider only the funds under discretionary management, which the institution can use to trade on behalf of the clients.

The amount of assets under management changes due to:

As a result of the factors above, the value of the assets under management changes constantly.

The factors mentioned above also determine how fast AUM changes. For example, other conditions held equal are:

However, the volatility in AUM may also depend on whether the securities owned are liquid or how often they are marked-to-market.

A fund with frequent and/or big inflows and outflows will experience more volatility in AUM, which will be an obstacle to the effective management of investing strategies, especially when the investments targeted are illiquid.

To avoid the potential damage of frequent inflows and outflows, institutions, such as mutual funds or hedge funds, can rely on some partial solutions:

The abovementioned measures are particularly helpful because:

If the volatility of AUM is under control, the fund is able to pursue its investment strategy without having to increase or decrease its positions because of inflows and outflows.

Whether we are dealing with banks, asset managers, insurance companies, or other financial institutions, the size of AUM is a measure of the company’s success. That’s because it is generally correlated with other KPIs.

Excessive growth in AUM can be a negative factor, especially for asset managers who invest with an active style and target outperformance vs. benchmarks.

Thank you for reading CFI’s guide on Assets Under Management (AUM). To keep advancing your career, the additional resources below will be useful:

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.